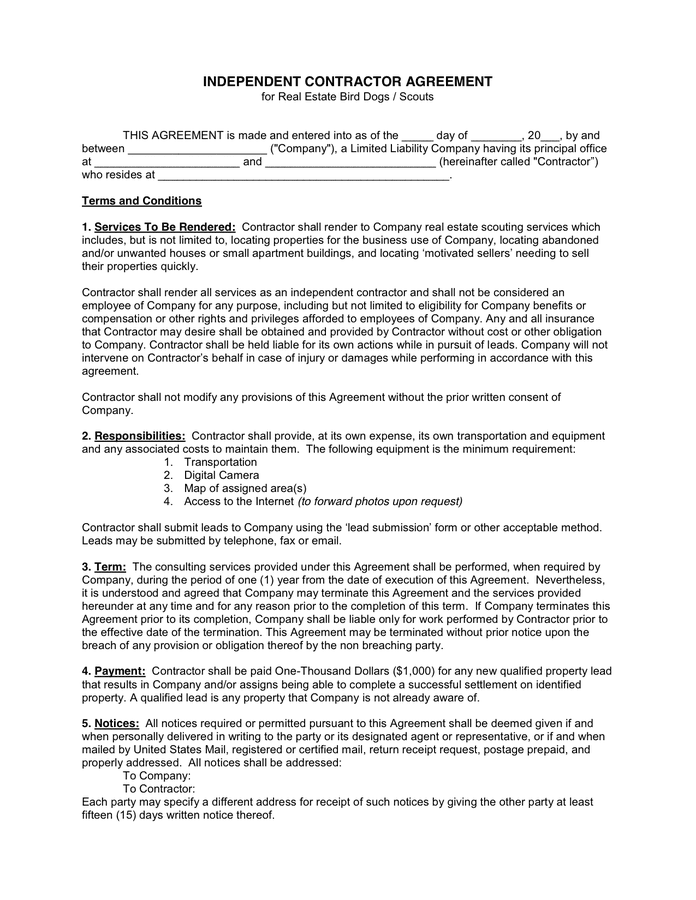

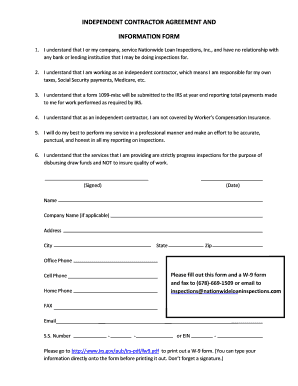

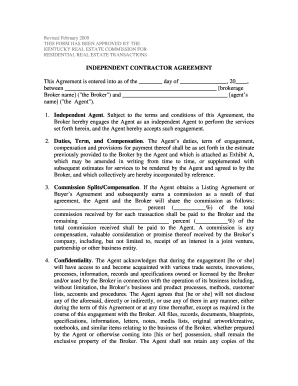

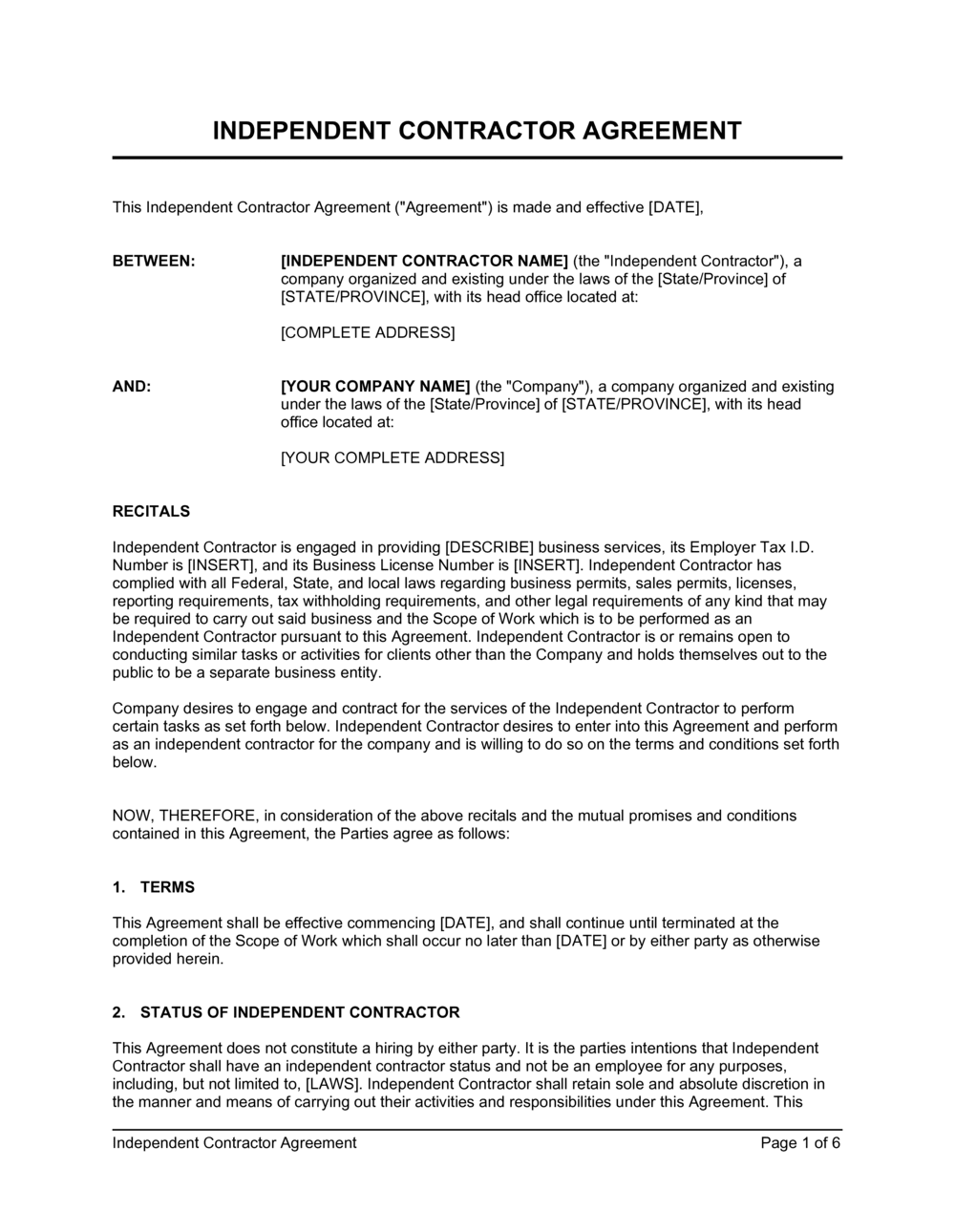

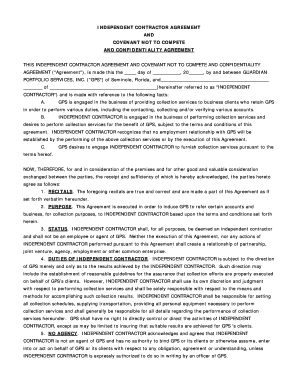

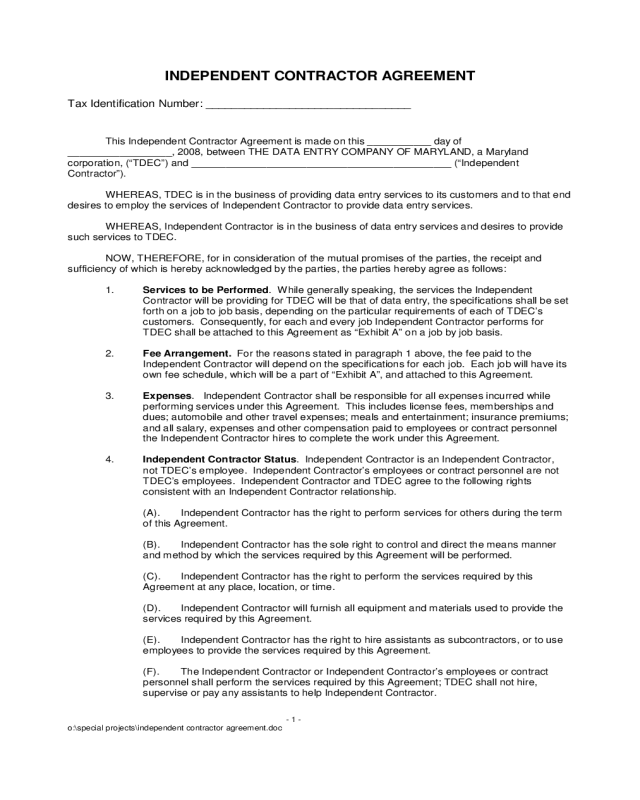

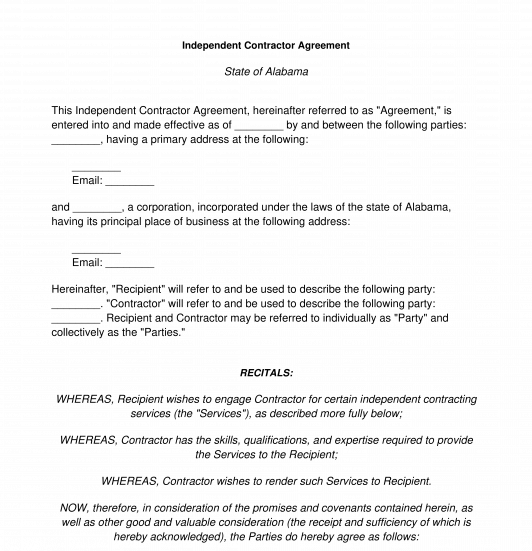

The independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosure agreementA truck driver independent contractor agreement is a document that legally binds a contractor and their client to a working arrangement Generally speaking, truck drivers are hired to transport goods from one facility to another or from a seller to a buyer A clear description of the tasks that the contractor is required to fulfill must be provided in the work agreement Furthermore, theYou are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

1

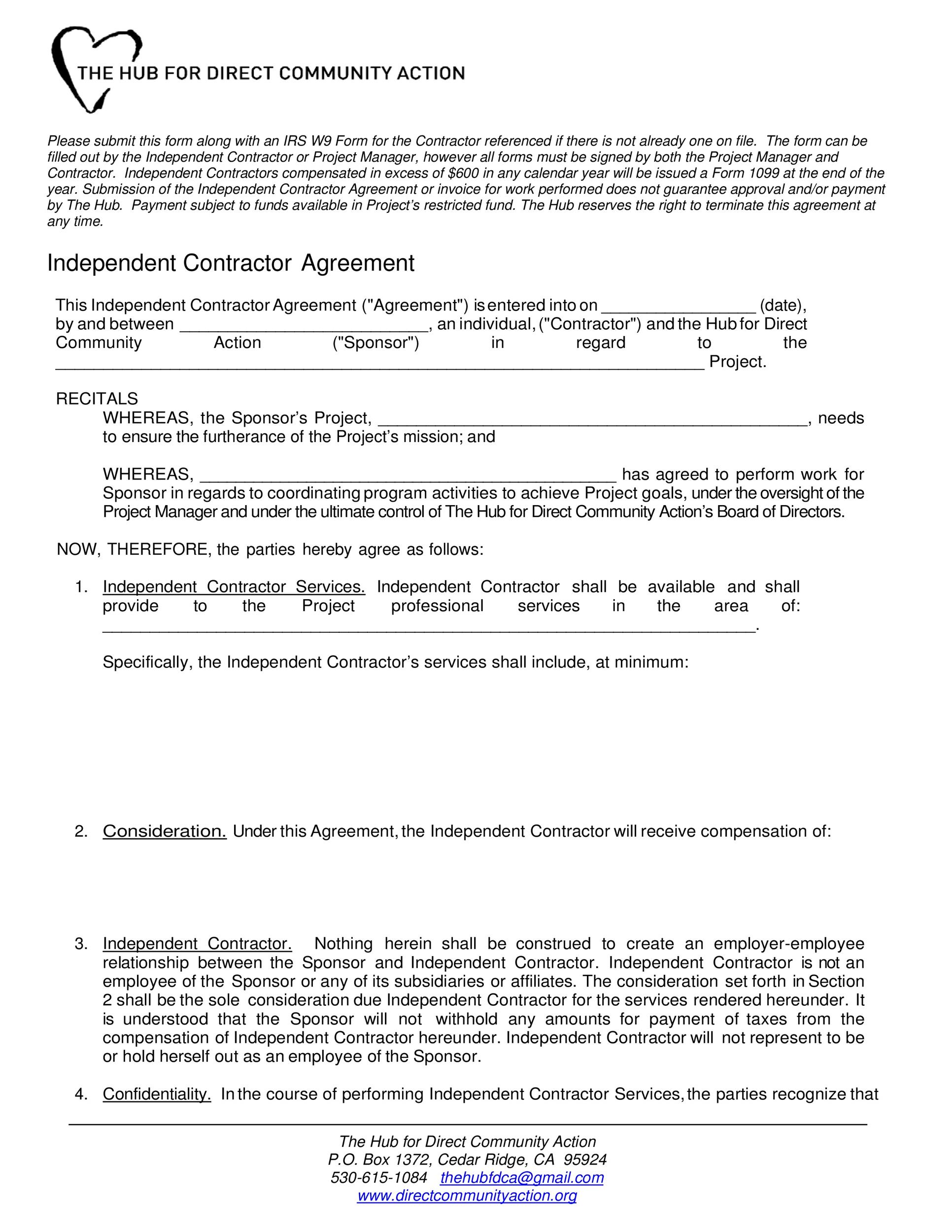

1099 contractor agreement pdf

1099 contractor agreement pdf-A copy of 1099‐MISC must be provided to the independent contractor by January 31 of the year following payment You must also send a copy of this form to the IRSA business owner needs an Independent Contractor Agreement for several reasons Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itselfIt is a clearcut explanation of the expected workflow, how communication will be handled, and how

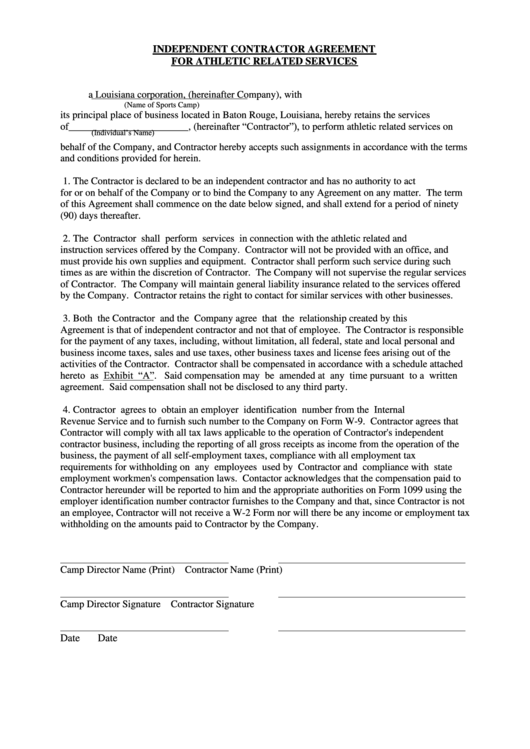

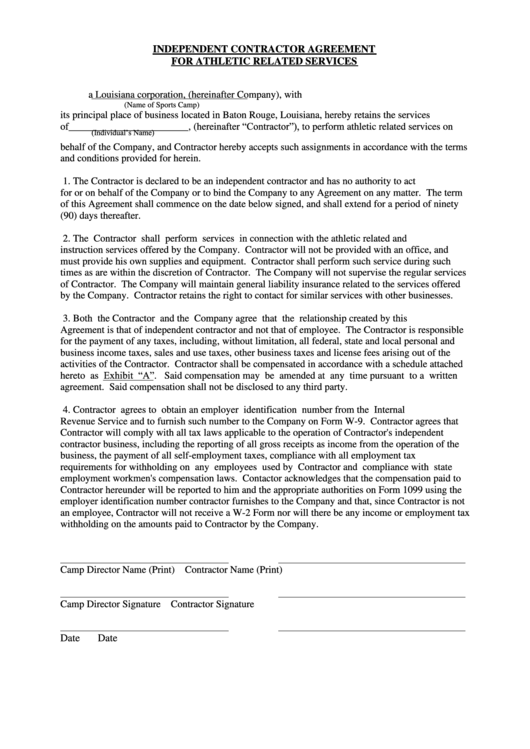

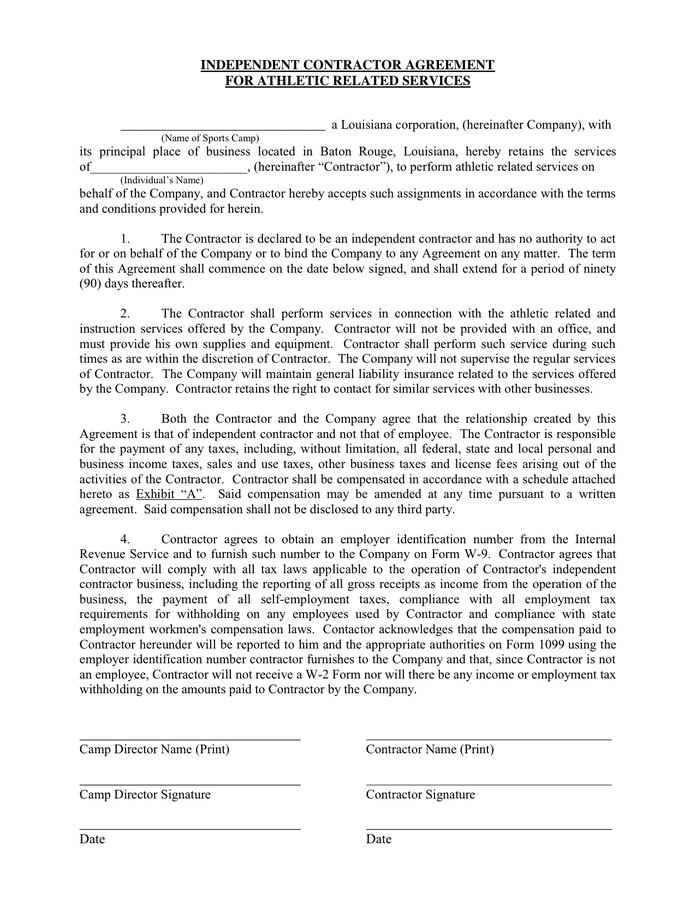

Independent Contractor Agreement For Athletic Related Services Form Printable Pdf Download

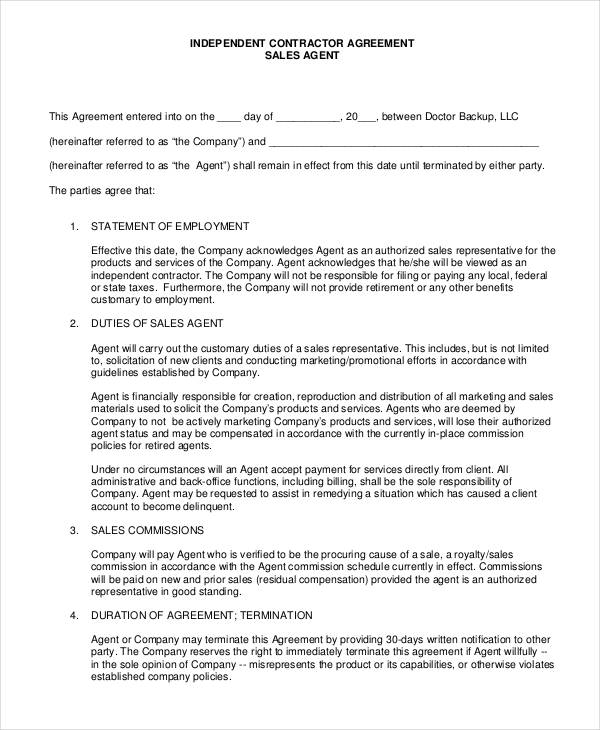

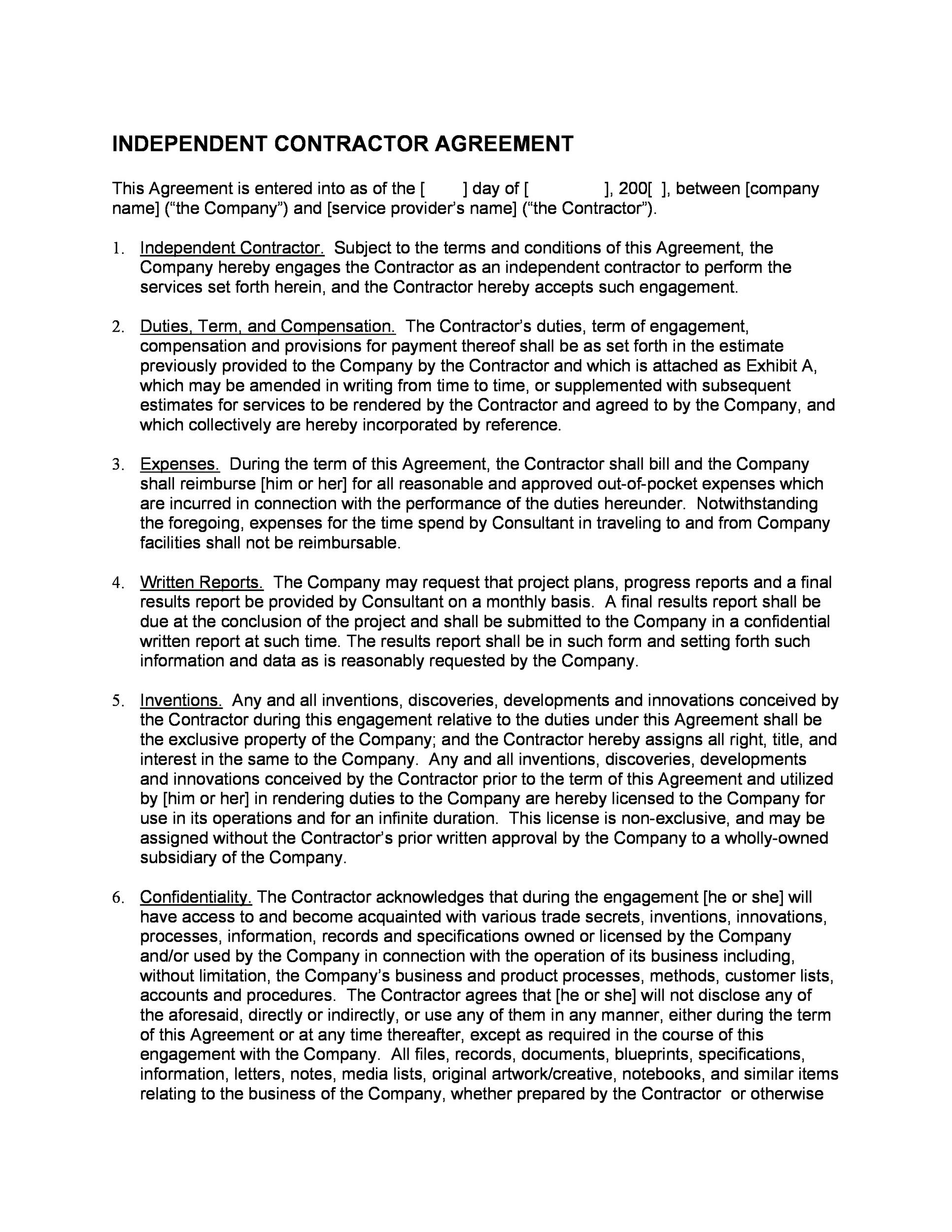

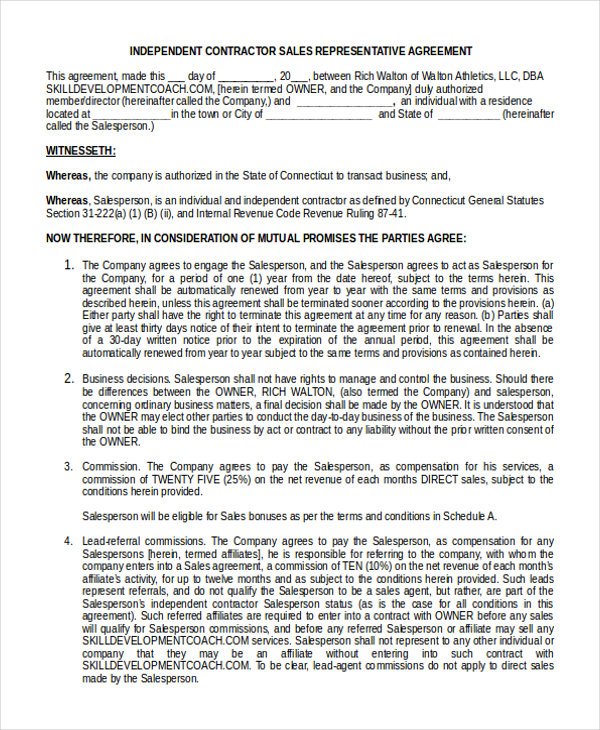

And (c) the Services andAgreement, disclose any such information or any part thereof to any person, firm, corporation, association or other entity for any reason or purpose whatsoever without the written permission of the Company 7 WRITTEN AGREEMENT CONSTITUES ENTIRE RELATIONSHIP This Agreement, along with any specified addendum, is a complete Agreement Any Updated A 1099 sales rep agreement is important to have for companies that employ sales representatives It can be the difference between staying open and being forced to shut down the company Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every year

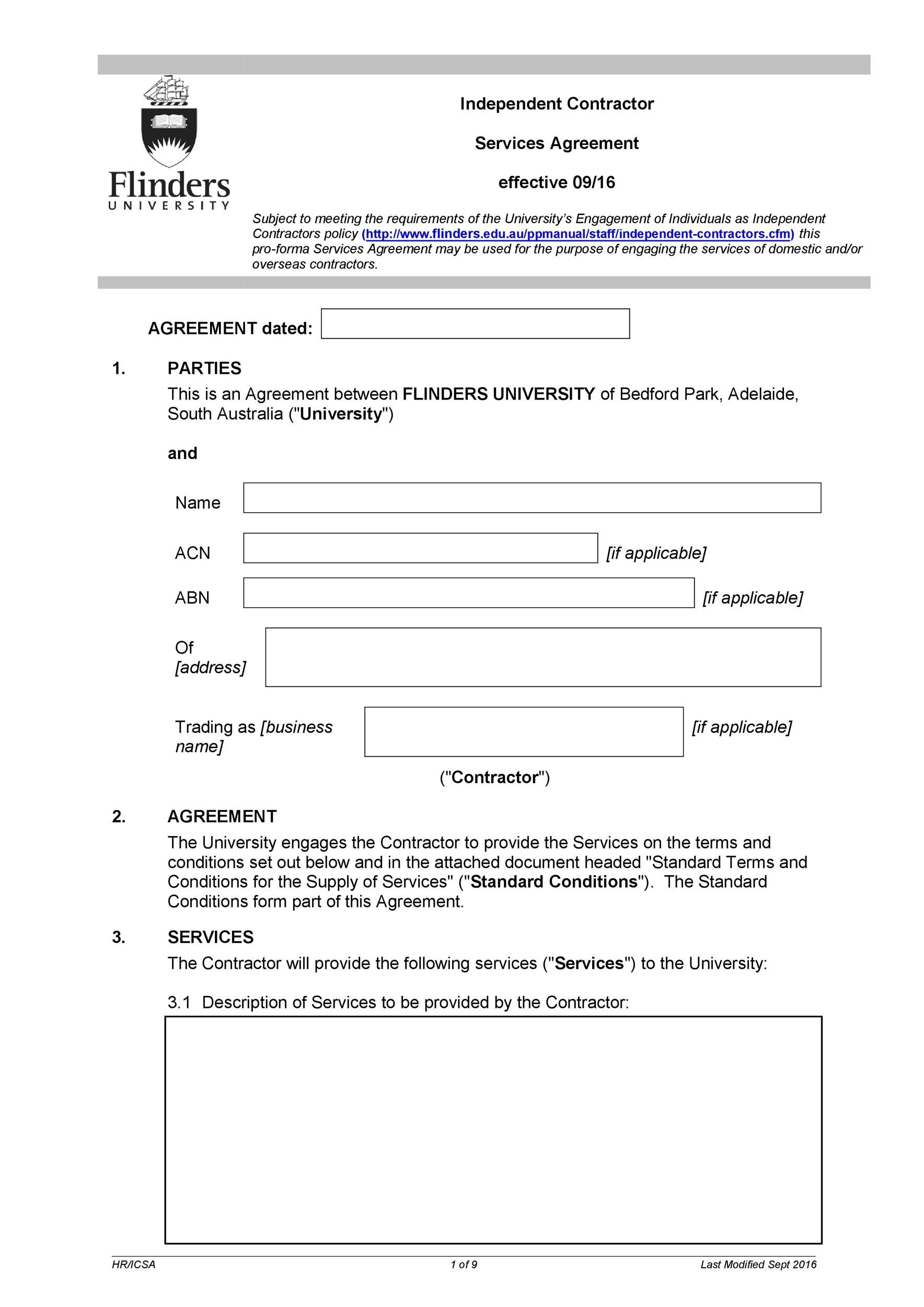

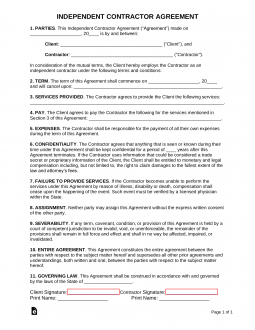

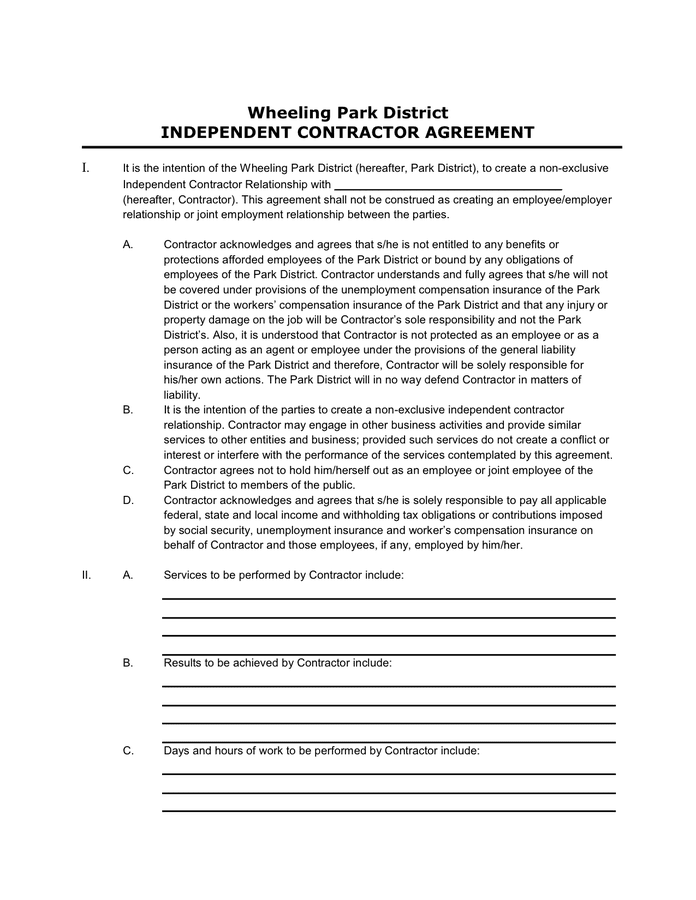

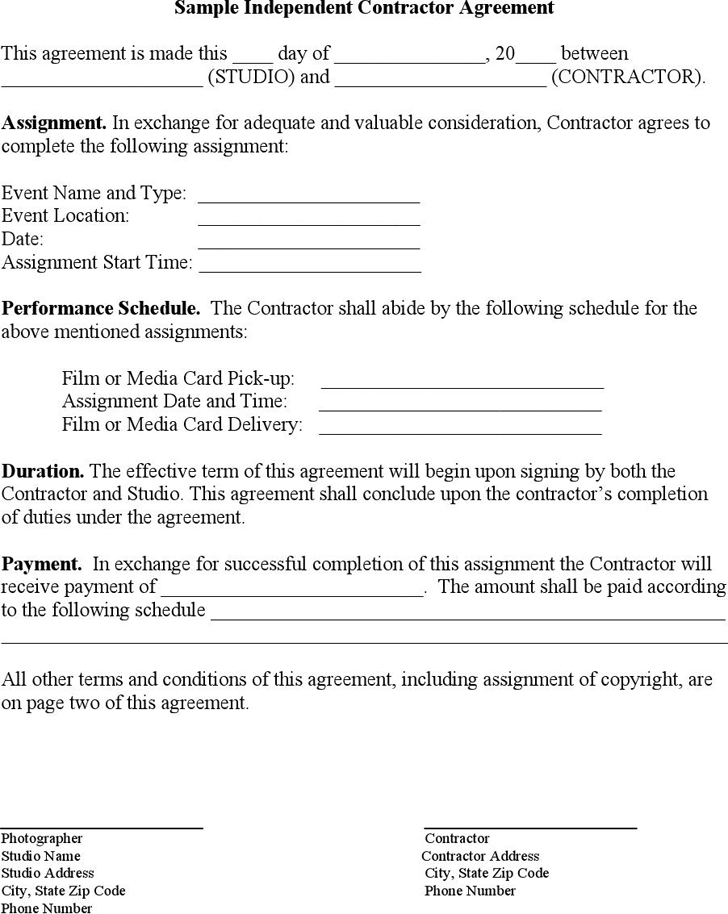

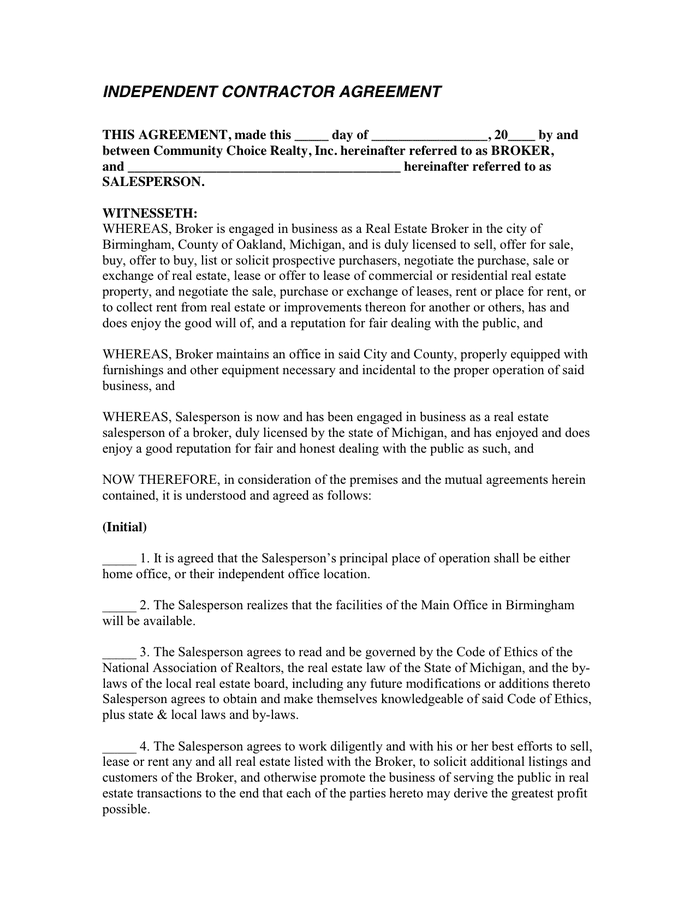

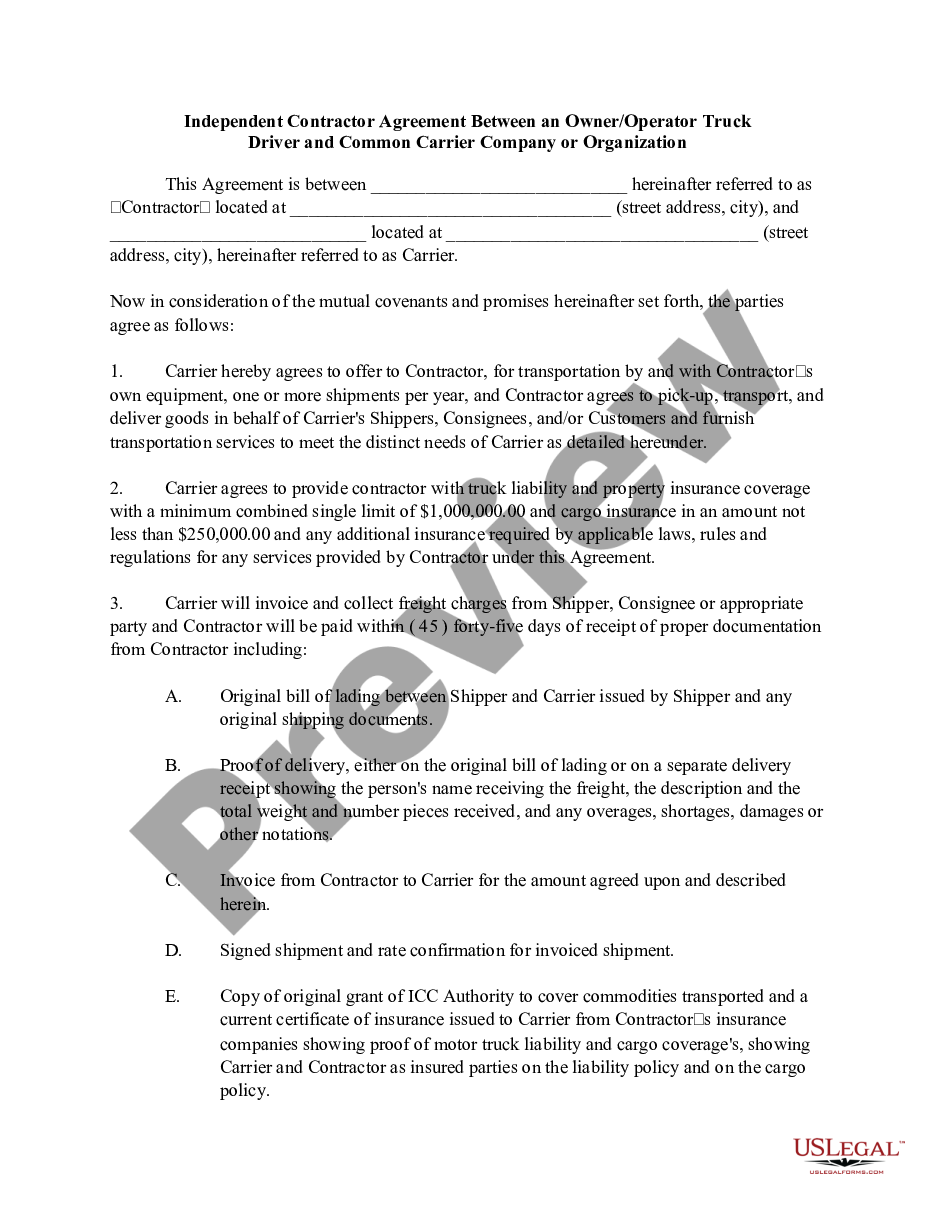

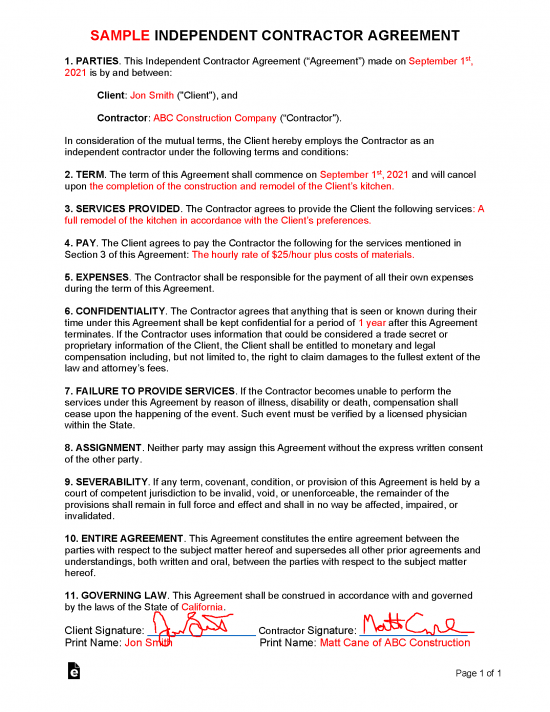

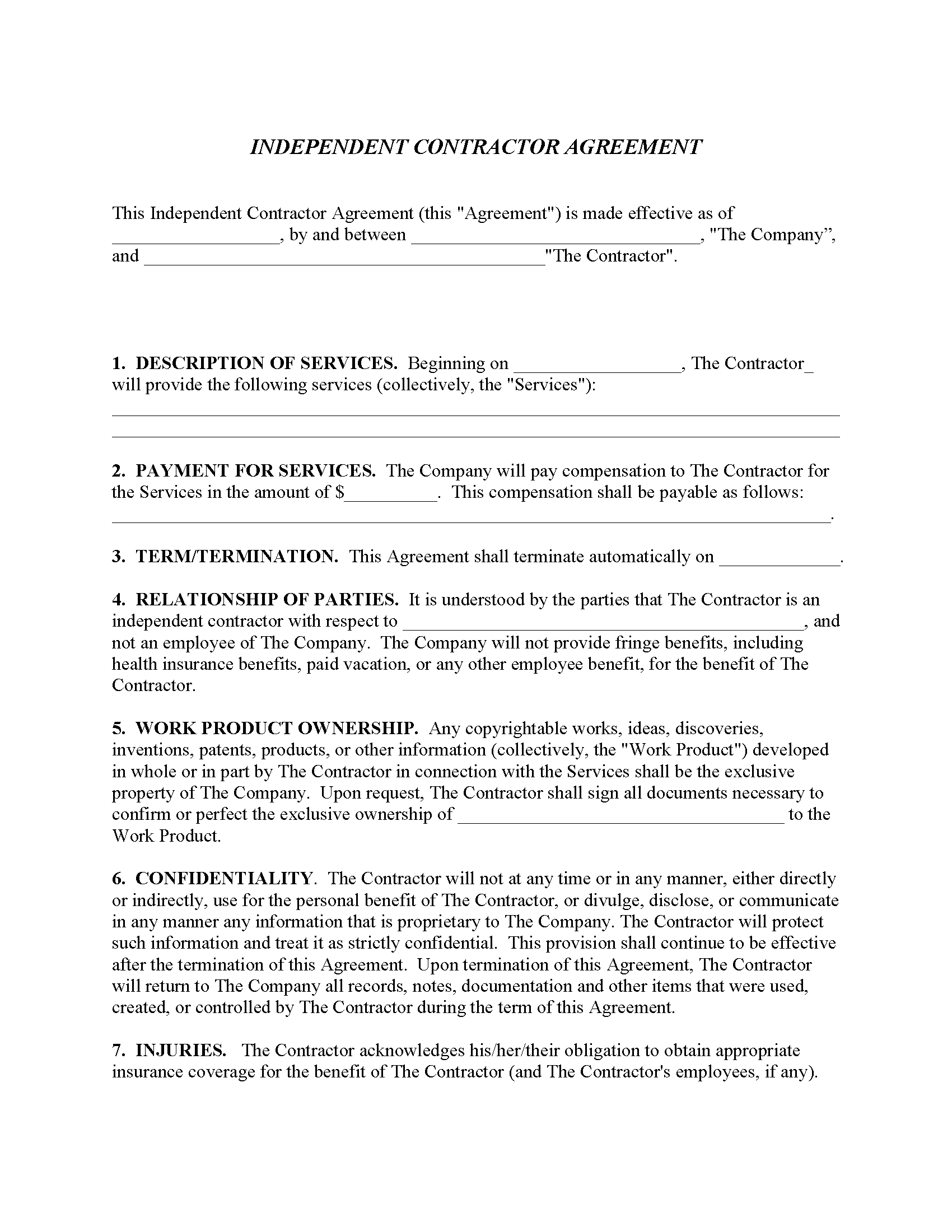

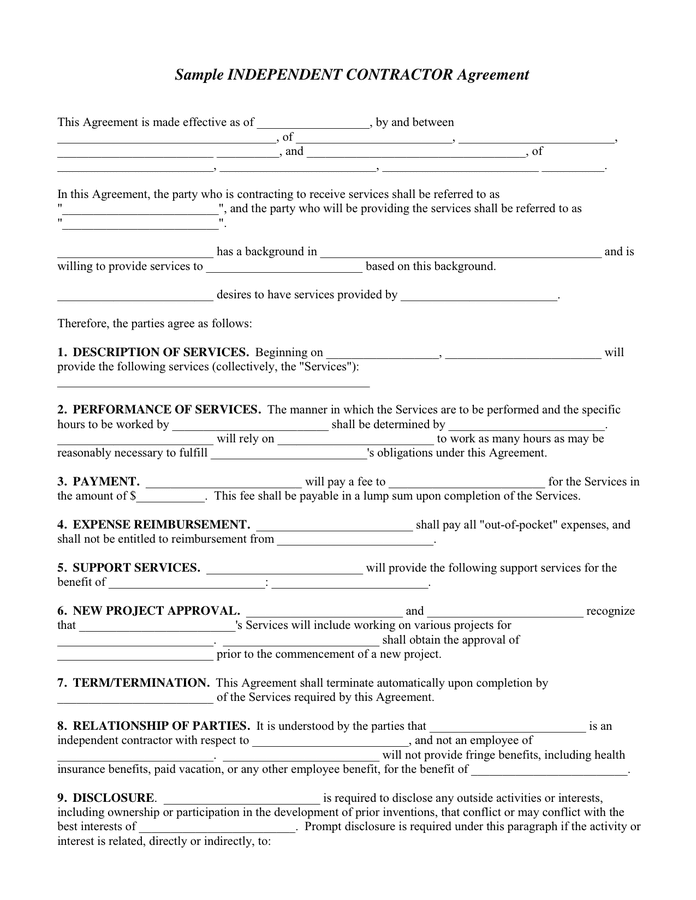

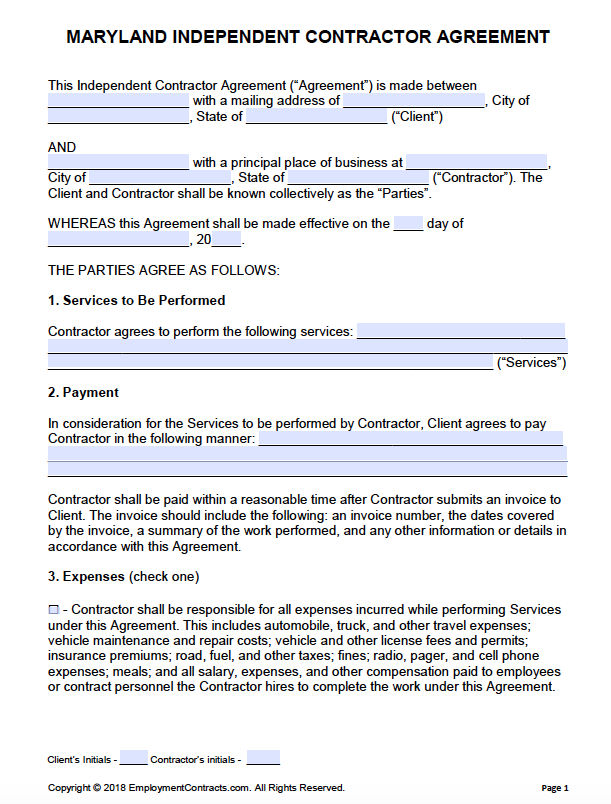

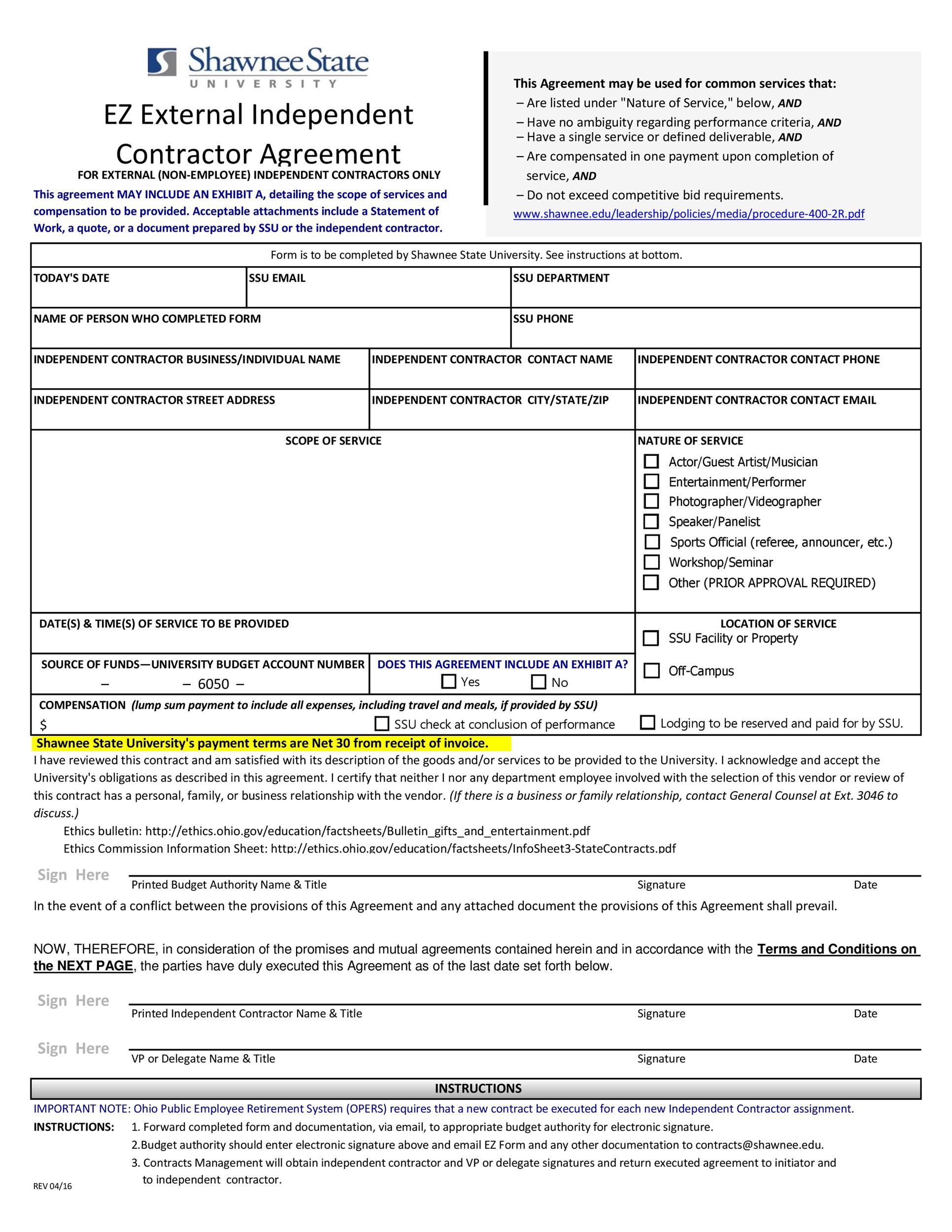

The agreement should include the entire agreement between the parties and should be signed and dated by both parties The contract should be kept in both the employer's and the contractor's records for future reference A witness may also be needed, or legal counsel can look over the agreementAn Independent Contractor Agreement, also known as a consulting agreement or freelance contract Describes the services being provided or project to be completed Outlines payment details and the length, or term of the contractOwner/Operator Lease Agreement AGREEMENT made this _____ day of _____, 1_, by and between LESSEE is a motor contract carrier of property authorized by the Federal Highway Administration by A 1099 worker is an independent contractor,

An independent contractor will be responsible for the payment of his own taxes, won't be eligible for any state or federal insurance, and is, most often, paid on a projecttoproject basis rather than on a recurring basis An independent contractor agreement, for tax purposes, is also known as a '1099' agreementCPE Labs – 1099 Contractor Agreement Page 2 of 3 or a different kind to be performed by its own personnel or other contractors during the term of this Agreement 23 Insurance CPE Labs provides insurance coverage for all employees Such insurance includes, but is not exclusive of other required insurance, General Liability, Workers W 9 form pdf fillable It is required to dispatch a copy of irs 1099 form independent contractor agreement to the respective personnel by january 31 of the year following the payment We use adobe acrobat pdf files as a means to electronically provide forms & publications Source assetswebsitefilescom Independent contractor 1099 invoice

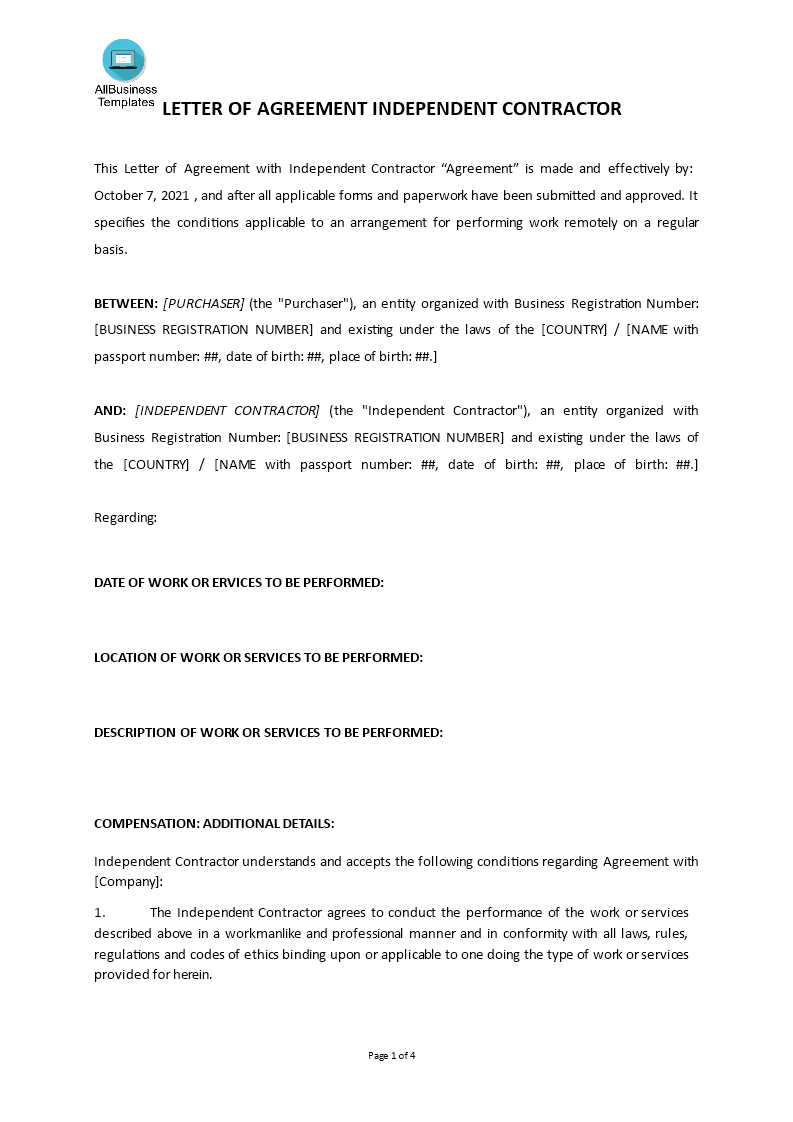

Letter Of Appointment For Independent Contractor Templates At Allbusinesstemplates Com

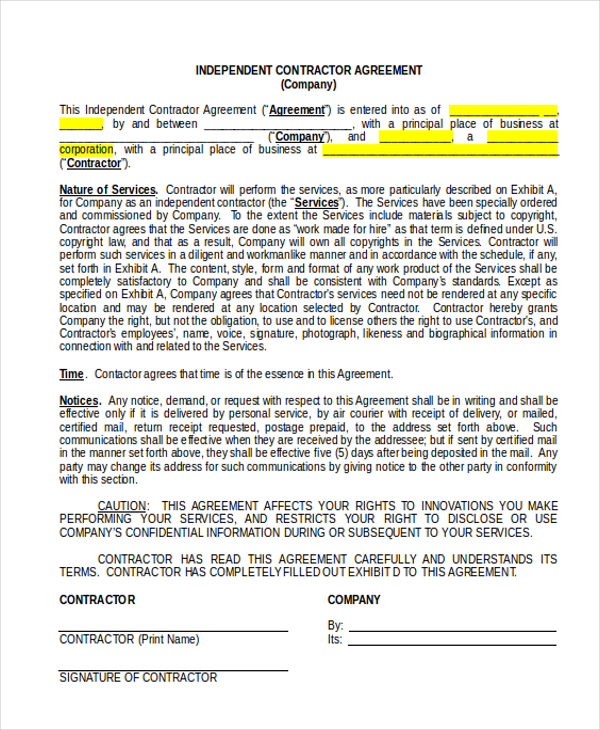

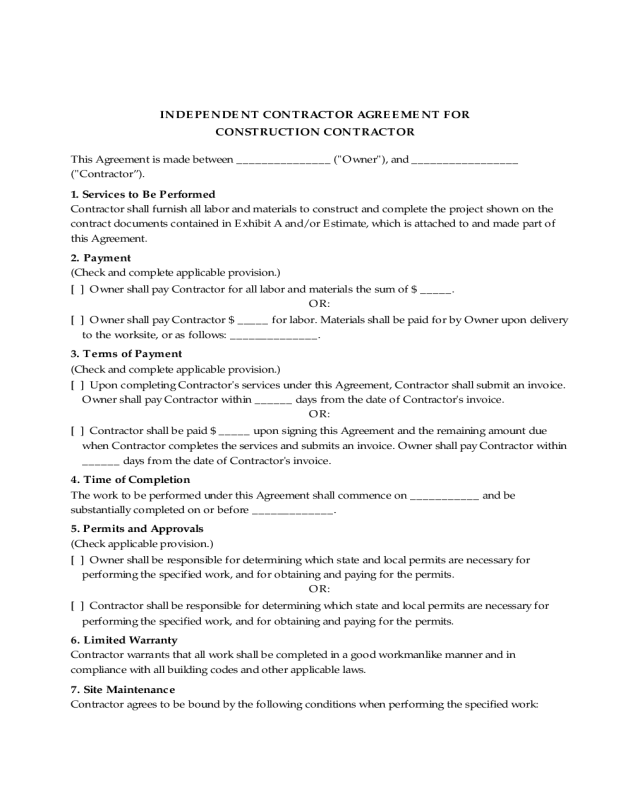

Free Printable Independent Contractor Agreement Form Contractor Contract Construction Contract Contract Template

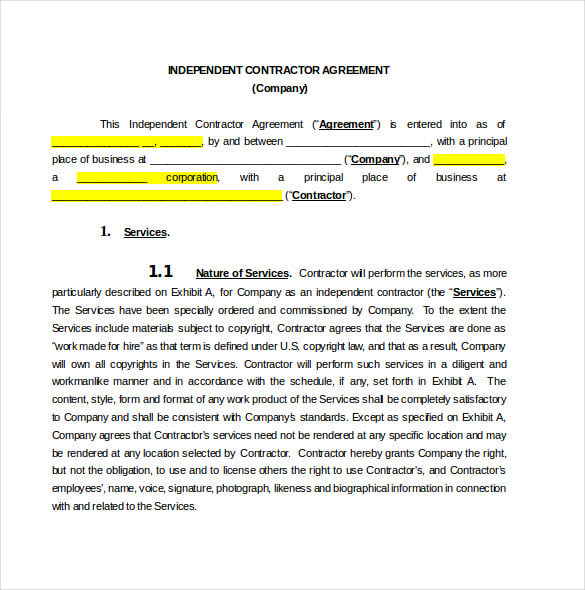

That in performing under the Agreement; Free Independent Contractor Agreement Template PDF from 1099 agreement template free , sourceeformscom provided free independent contractor agreement template pdf an independent contractor agreement also known as a '1099 agreement' is a contract between a client willing to pay for the performance of services by a contractor privateClient will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees

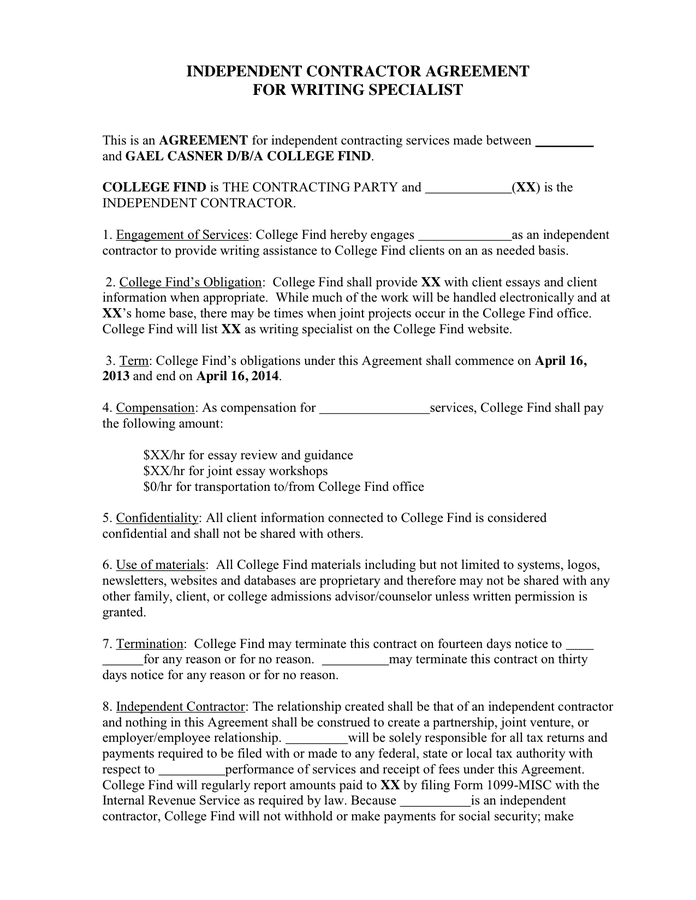

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement For Download

NTEU and IRS have been negotiating nationalterm contracts for nearly 50 years and each new agreement has improved upon the preceding one These innovative contracts protect the rights of IRS employees, improve workingCompany agrees to provide the Contractor with a 1099 form by the 31st of January each year with regards to all monies paid to the Contractor in association with this Agreement Nondisclosure and Confidentiality Company and Contractor acknowledge and confirm that Contractor may by virtue of Contractor's relationship with Company as contemplated The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Independent Contractor Agreement 1 Legalforms Org

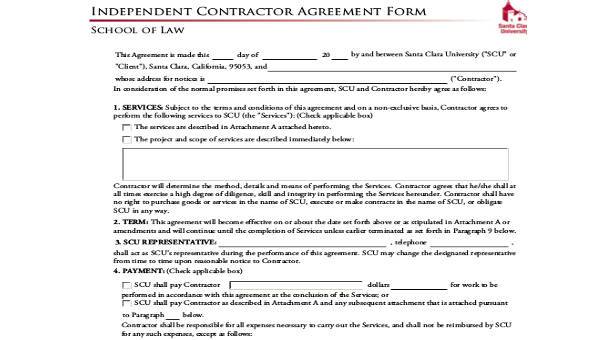

Contract, however, the contract may be ignored The actual facts in each situation are more important than a contract, but the contract may be a deciding factor, all other things being equal Example Lindy, an electrician, bid on a job at $3000 an hour She estimated the job would take 400 hours She would be paid $2,400 every two weeks forIndependent Contractor Agreement Note This document does not reflect or constitute legal advice This is a sample made available by the Organizations and Transactions Clinic at Stanford Law School on the basis set out at nonprofitdocumentslawstanfordedu Your use of this document does not create an attorneyclient An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreements

Independent Contractor Agreement In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter AGREEMENT CONTRACTOR agrees to accept and hold CONFIDENTIAL INFORMATION obtained from COMPANY in confidence at all times during and(b) Contractor will not violate the terms of any agreement with any third party;An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for paymentThe client will have no responsibility for employees, subcontractors, or personnel in connection with the services provided Their only obligation will be to pay the independent contractor with no liability if anyone should get injured during the

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor Application Fill Online Printable Fillable Blank Pdffiller

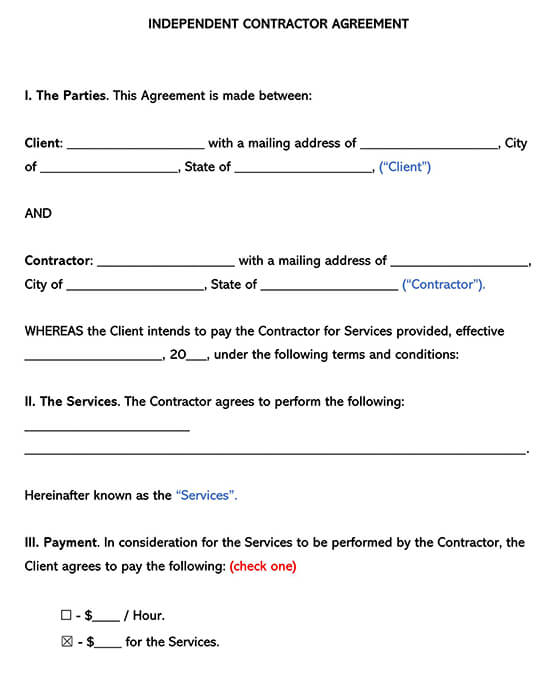

free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreement template pdfA one (1) page independent contractor agreement is a simple version that identifies the services provided and payment while stating the general terms and conditions of a standard agreement Under this agreement, the parties have to ensure that certain clauses are mentioned in an effort to be recognized under State and federal laws to sustain the contractor's statusIf you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099NEC needs to be completed, and a copy of 1099NEC must be provided to the independent contractor by January 31 of the year following payment

Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Agreement 16 Free Pdf Google Docs Apple Pages Format Free Premium Templates

Contractor represents and warrants to Company that (a) Contractor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company;Redesigned Form 1099MISC Due to the creation of Form 1099NEC, we have revised Form 1099MISC and rearranged box numbers for reporting certain income Changes in the reporting of income and the form's box numbers are listed below • Payer made direct sales of $5,000 or more (checkbox) in box 7 • Crop insurance proceeds are reported inIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, Agreement Independent Contractor agrees that customers of the Company shall

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

3

Find Form W9, Form 1099 and instructions on filing electronically for independent contractors Form W9 If you've made the determination that the person you're paying is an independent contractor, the first step is to have the contractor complete Form W9, Request for Taxpayer Identification Number and CertificationHIPAA Compliance Contractor agrees to respect and abide by all federal, state and local laws pertaining to confidentiality with regard to all information and records obtained or reviewed in the course of providing Services under this Agreement Contractor agrees to adhere to policies and procedures adopted by the Companies and all federalContractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 Services Provided The Employer shall pay to the Independent Contractor and the

Create An Independent Contractor Agreement Download Print Pdf Word

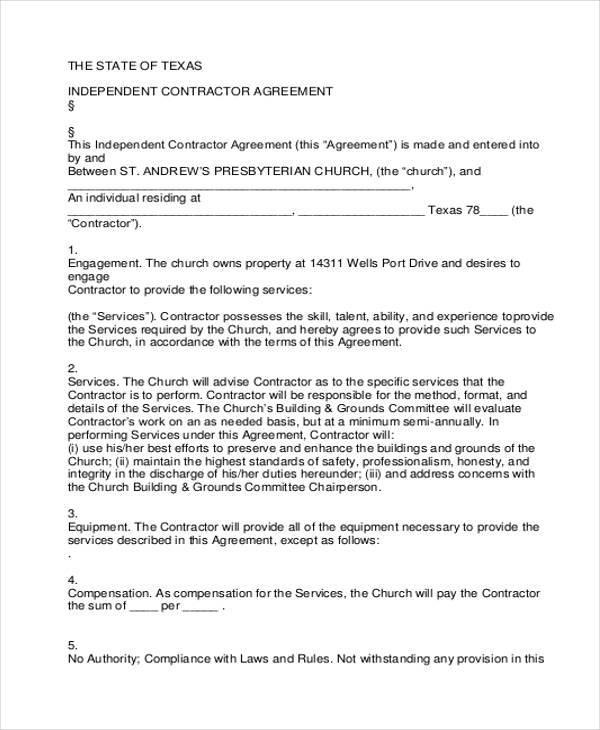

Free Texas Independent Contractor Agreement Pdf Word

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesContractor under another law (for example, tax law or state law), you may still be an employee under the FLSA Receiving a 1099 does not make you an independent contractor under the FLSA Signing an independent contractor agreement does not make you an independent contractor under the FLSA Whether you are paid by cashIndependent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf of

50 Free Independent Contractor Agreement Forms Templates

3

This Agreement Contractor will continue to have such certificates, permits, registrations, authorizations and licenses in full force and effect at all times while providing services under the terms of this Agreement Carrier desires to enter into an agreement to engage Contractor, as an independent contractor,Any customer as a house account, without the Representative's agreement 6 Independent Contractor It is understood that the Representative is an independent contractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood that A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to

Independent Contractor Agreement Template Free Pdf Sample Formswift

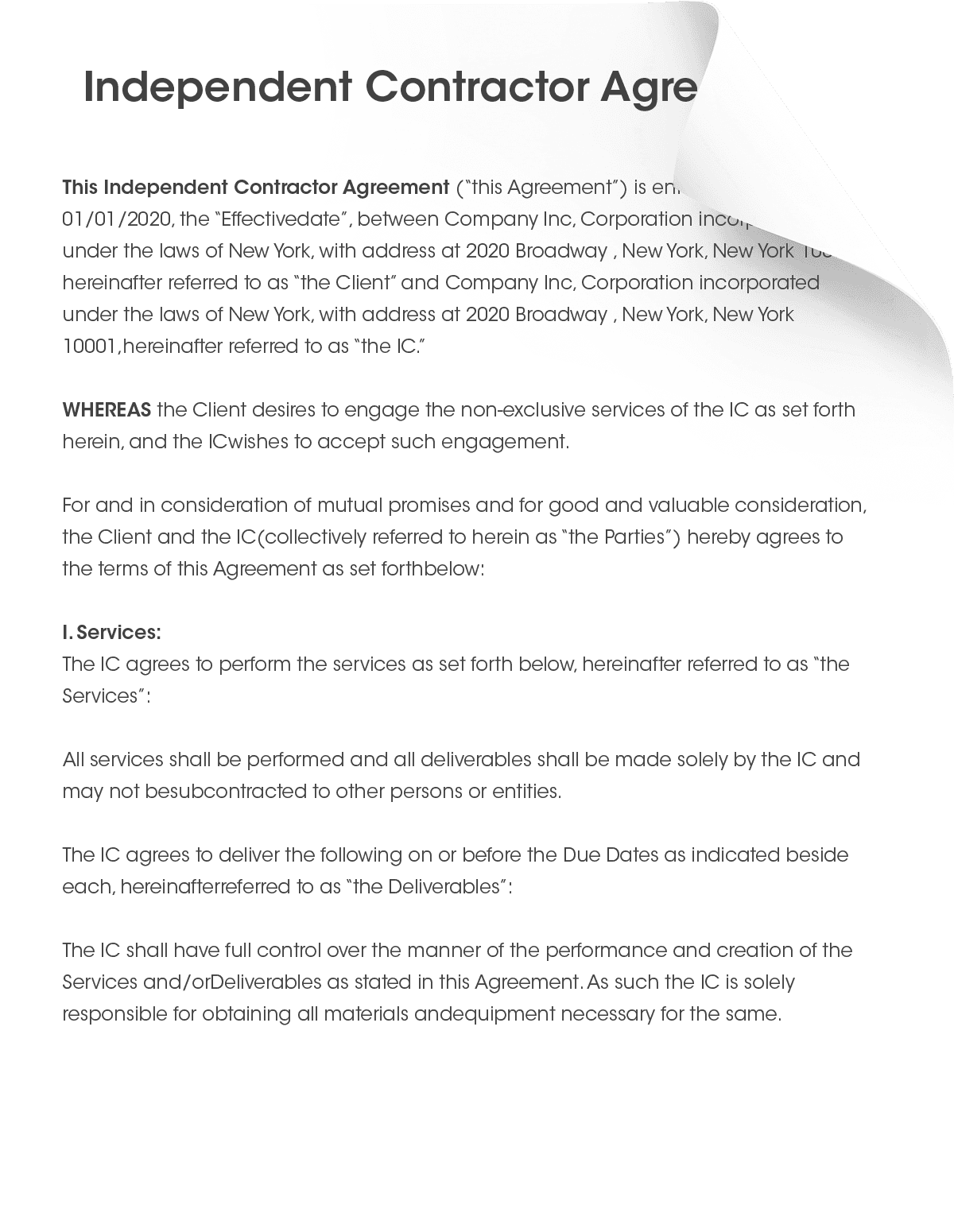

2

The Contractor and Subcontractor agree as follows 1 CONTRACT DOCUMENTS (a) The contract documents for this subcontract consist of this Agreement and any exhibits named herein, the General Contract (including all general and special conditions, plans, drawings, and specifications issued prior to the execution of this Agreement), along with allService (IRS), is an independent contractor, and neither the Contractor's employees or contract personnel are, or shall be deemed, the Client's employees In its capacity as an independent contractor, Contractor agrees and represents Contractor has the right to perform services for others during the term of this Agreement; Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these

Free Independent Contractor Agreement Pdf Word

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

A truck driver performing services for a company under a contract referring to him as an independent contractor, but who is subject to the direction and control of the company, is an employee of the company for employment tax purposes Revenue Ruling , CB 336A subcontractor agreement is between a contractor and a subcontractor that is hired to complete a task that is part of a larger project The subcontractor is considered a 1099 independent contractor, not an employee, which means they are liable for the payment of their own Federal and State withholding taxes1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Contractor Agreement, which are incorporated herein by reference DESCRIPTION OF SERVICES AND PROJECT MILESTONES The Services to be performed by Contractor are as follows

Independent Contractor Agreement Pdfsimpli

Free Florida Independent Contractor Agreement Pdf Word

Contractor may at its discretion engage subcontractors to perform services under thi s Agreement, but Contractor shall remain responsible for proper completion of this Agreement 9 Independent Contractor Status Contractor is an independent contractor, not Owner's employee Contractor's employees or subcontractors are not Owner's employeesAgreement ☐ Contractor has the sole right to control and direct the means, manner, and method by which the Services required by this Agreement will be performed Contractor shall select the routes taken, starting and quitting times, days of work, and order the work is performedA 1099 subcontractor agreement is utilized when a subcontractor has been hired to complete a service for more than $600 The contractor must then provide the 1099MISC form to the subcontractor by January 31 st of the following year in which the payment was provided How to Use a 1099 Subcontractor Agreement The following steps should be followed in order to utilize a 1099

Independent Contractor Agreement For Construction Edit Fill Sign Online Handypdf

1

INDEPENDENT CONTRACTOR AGREEMENT It is understood and agreed that HWS shall provide Contractor with a Form 1099 in accordance with applicable federal, state, and local income tax laws by facsimile or in pdf format and in one or more counterparts, each of which shall, for all purposes, be deemed an

50 Free Independent Contractor Agreement Forms Templates

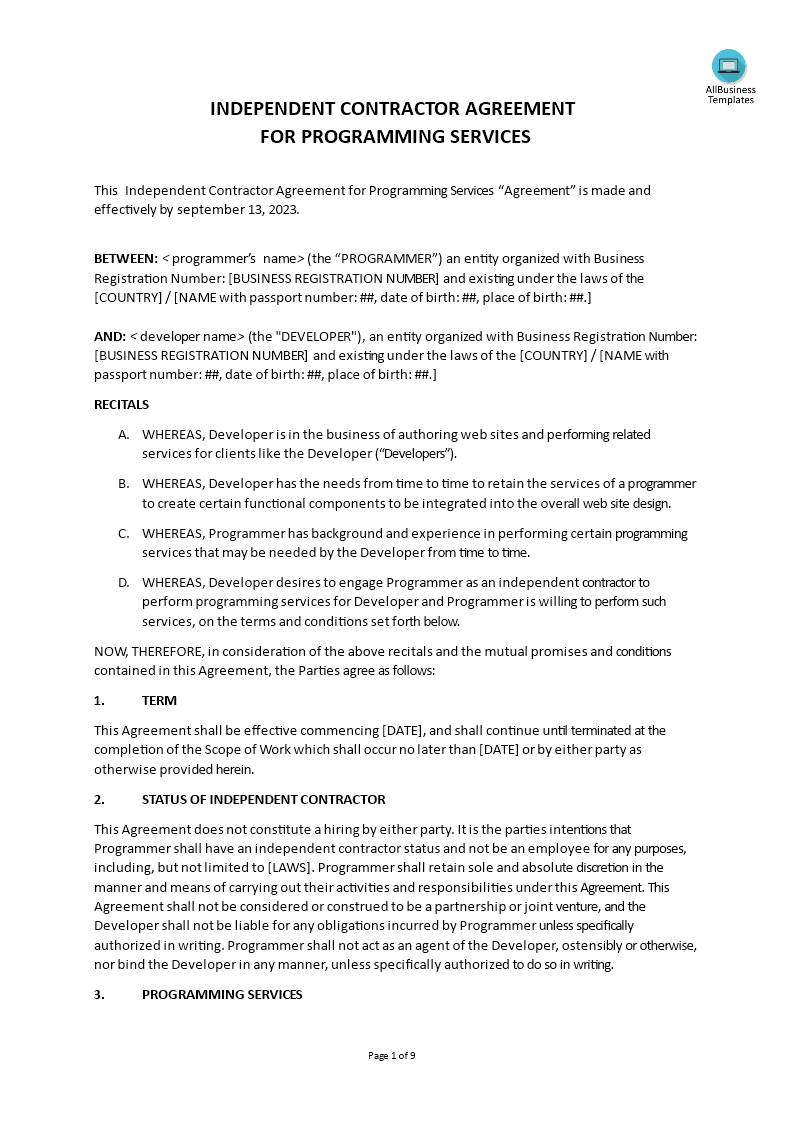

Independent Contractor Agreement Programming Templates At Allbusinesstemplates Com

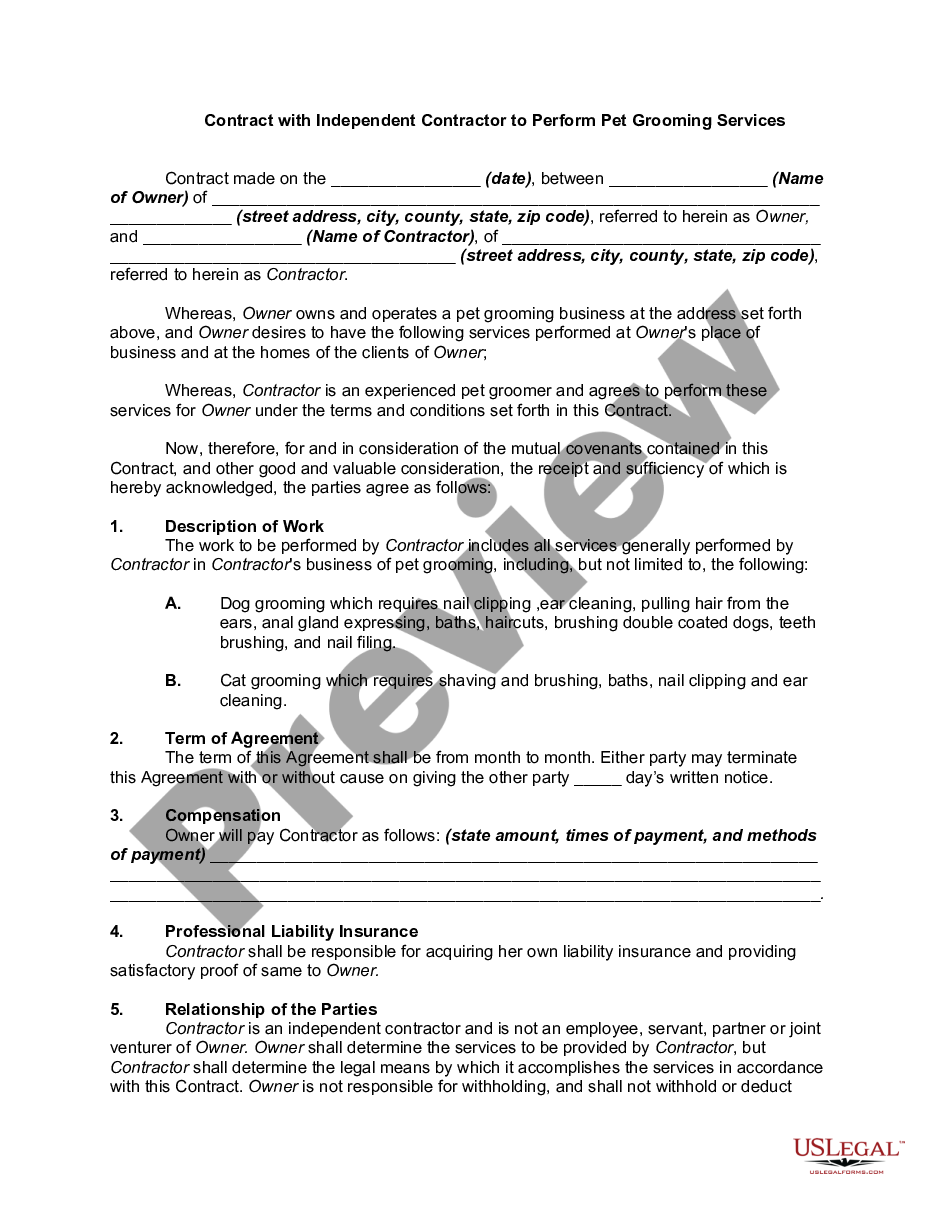

Contract With Independent Contractor To Perform Pet Grooming Services Pet Groomer Independent Contractor Agreement Us Legal Forms

73 Printable Independent Contractor Agreement Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Independent Contractor Agreement Template What To Avoid

Independent Contractor Agreement For Athletic Related Services Form Printable Pdf Download

1099 Form Independent Contractor Agreement

Independent Contractor Agreement Short Form In Word And Pdf Formats

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Template Approveme Free Contract Templates

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free Sample Independent Contractor Agreement Pdf 11kb 2 Page S

Contractor Agreement Template 23 Free Word Pdf Apple Pages Document Download Free Premium Templates

Independent Contractor Agreement Form 53 Simple Joint Venture Agreement Templates Pdf Doc A Templatelab Answer A Few Simple Questions

Independent Contractor Agreement Pdf Pdf Independent Contractor Registered Mail

50 Free Independent Contractor Agreement Forms Templates

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Simple Independent Contractor Agreement Contractor Contract Contract Template Contract Agreement

Independent Contractor Agreement In Word And Pdf Formats

Massage Therapist Independent Contractor Agreement In Word And Pdf Formats

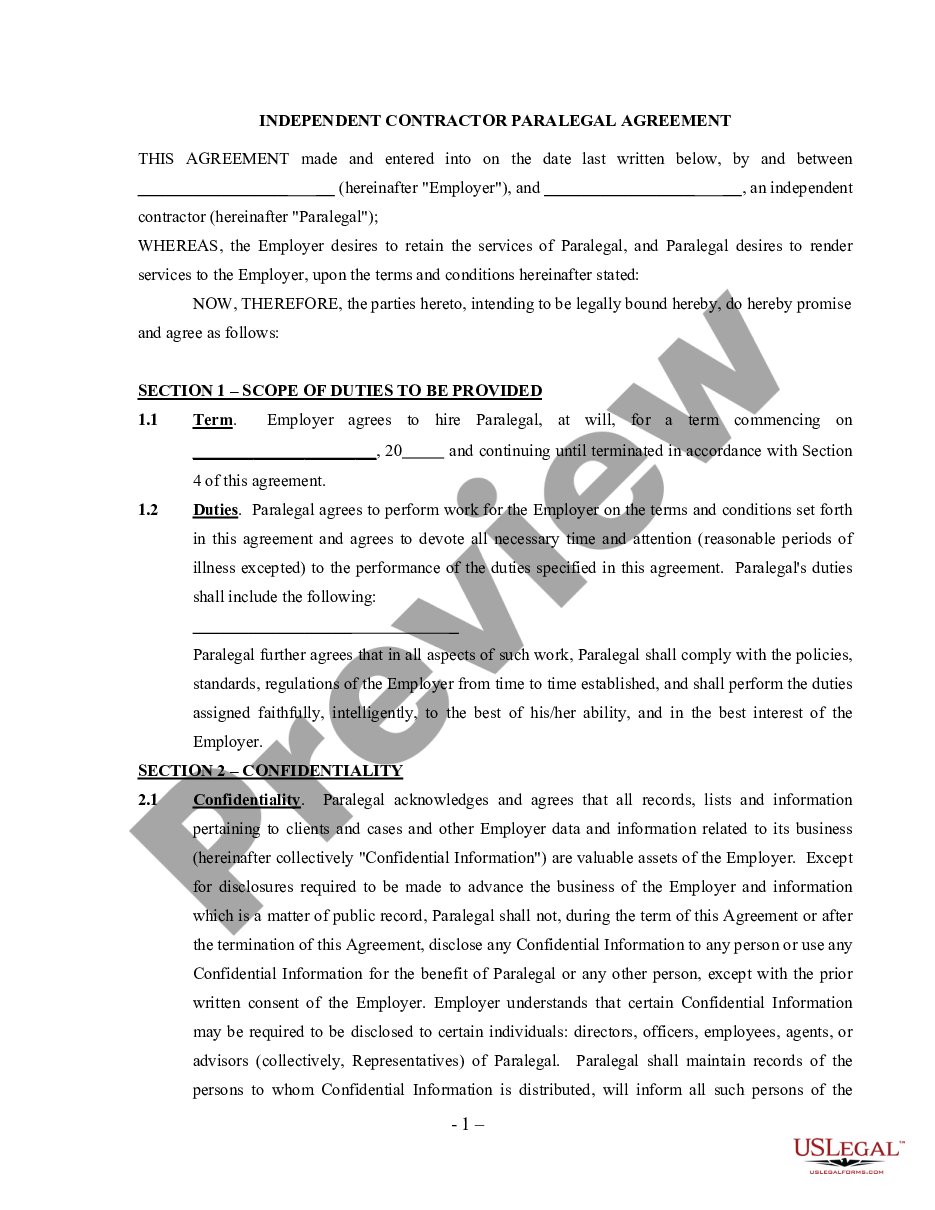

Paralegal Agreement Self Employed Independent Contractor Paralegal Independent Contractor Agreement Us Legal Forms

50 Free Independent Contractor Agreement Forms Templates

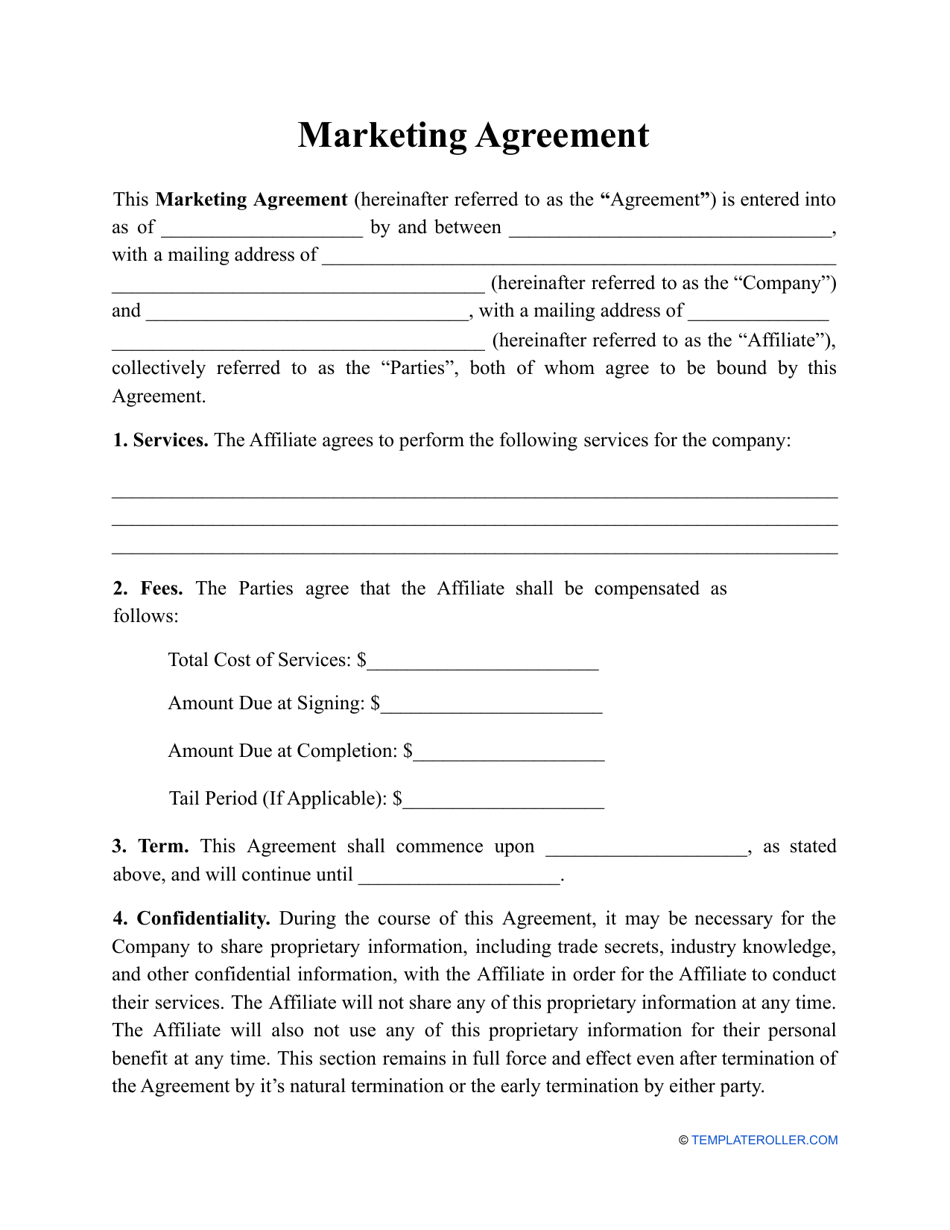

Marketing Agreement Template Download Printable Pdf Templateroller

Create A Free Construction Contract Agreement Legal Templates

Free Independent Contractor Agreement Template Download Wise

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Contract Template The Contract Shop

Free Independent Contractor Agreement Templates Word Pdf

Contractor Agreement Form Pros

Kentucky Independent Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Agreement Template By Business In A Box

Free 6 Sample Independent Consulting Agreement Templates In Ms Word Pdf

Independent Contractor Agreement Template Word Pdf Download Tracktime24

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Agreement Pdf Template Kdanmobile

3

Self Owner Operator Independent Contractor Agreement Us Legal Forms

Free 11 Contractor Agreement Samples In Ms Word Pdf Excel

Free Independent Contractor Agreement For Download

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

T0iop8gnzmtpam

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

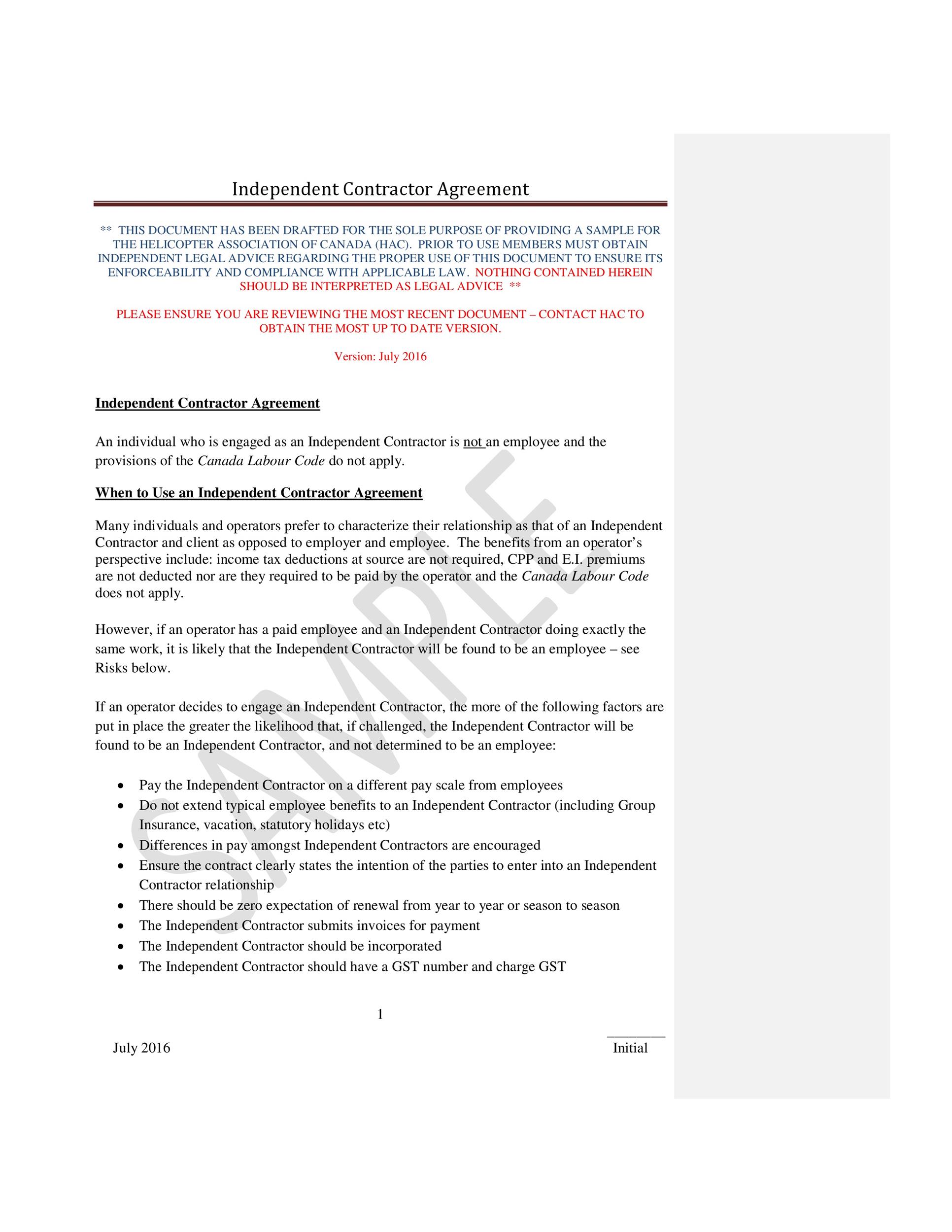

Cc Independent Contractor Agreement Pdf Sportmedbc

免费 Independent Contractor Release Of Liability Form 样本文件在 Allbusinesstemplates Com

Pin On Agreement Template

Independent Contractor Agreement Form Edit Fill Sign Online Handypdf

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Independent Contractor Agreement Sample Template

Independent Contractor Agreement Form 11 Subcontractor Agreement Template For Successful Contra Contractor Contract Contract Template Independent Contractor

Free Independent Contractor Agreement Free To Print Save Download

Free Independent Contractor Agreement Template For 21 Bonsai

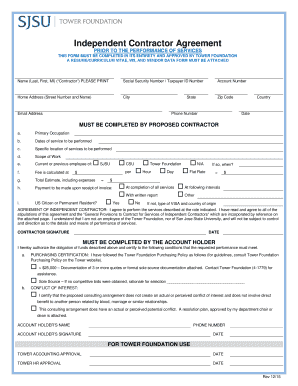

Fillable Online Sjsu Independent Contractor Agreement Form Fax Email Print Pdffiller

Free 10 Sample Independent Contractor Agreement Forms In Ms Word Pdf Excel

Louisiana Independent Contractor Agreement Pdf Free Printable Legal Forms

Free Texas Independent Contractor Agreement Word Pdf Eforms

Independent Contractor Agreement 3 Legalforms Org

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Sample Independent Contractor Agreement In Word And Pdf Formats

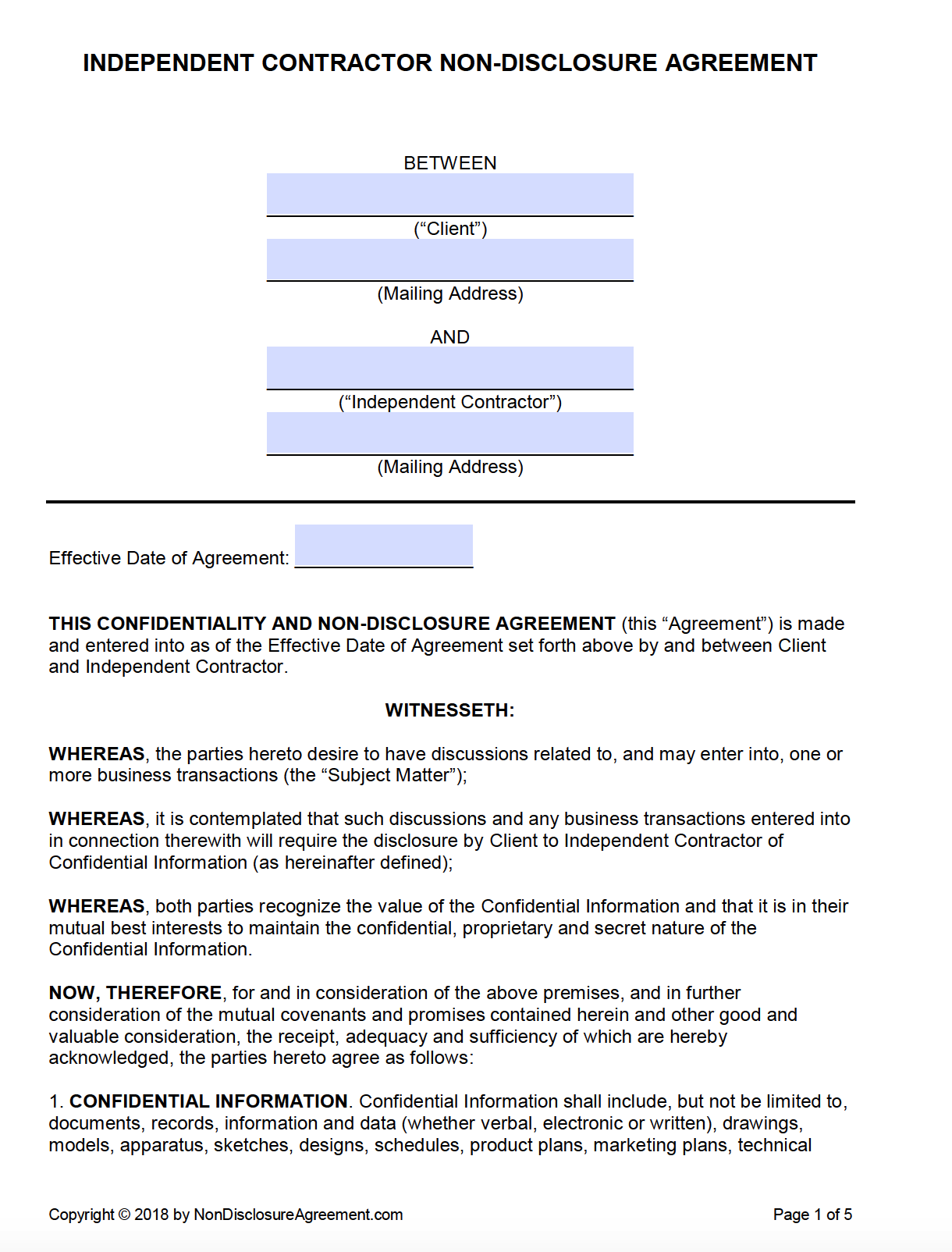

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

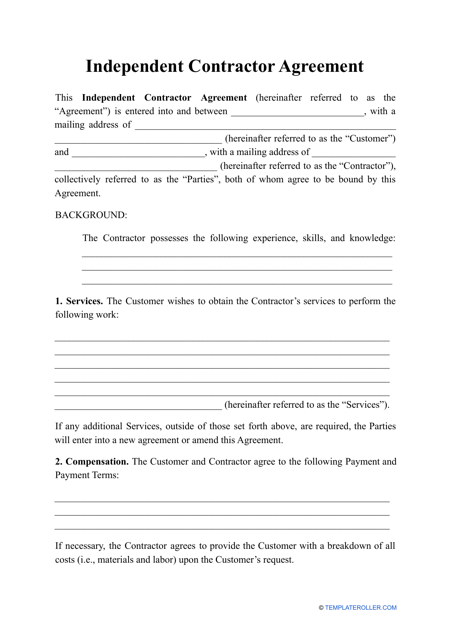

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Www Southalabama Edu Departments Eforms Businessoffice Independentagreement Pdf

50 Free Independent Contractor Agreement Forms Templates

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Independent Contractor Agreement Arizona Beautiful Independent Contractor Agreement Pdf Relationship Contract Template Models Form Ideas

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Independent Contractor Agreement Template Download Printable Pdf Templateroller

In Nau Edu Wp Content Uploads Sites 2 18 06 Independent Contractor Agreement Ek Pdf

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

1099 Contract Employee Agreement

Free 22 Sample Independent Contractor Agreement Templates In Google Docs Ms Word Apple Pages Pdf

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Legalforms Org

Free Salon Independent Contractor Agreement Template Pdf Word Eforms Free Fillable Forms Independent Contractor Salons Contractors

Free Maryland Independent Contractor Agreement Pdf Word

50 Free Independent Contractor Agreement Forms Templates

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

0 件のコメント:

コメントを投稿